Order Types

Stop Orders

A Stop Order is an order to buy or sell when the price moves past a predefined threshold, also known as the Stop Price. Once it is crossed, a Stop Order becomes a Market or Limit Order. Stop Order is an order which, when accepted, does not immediately go on the book, but must be “triggered” to be activated.

The trigger is a trade that occurs at a price, specified by the order - the trigger price. Once a trade occurs at the trigger price, the order is activated. At this moment, the order enters the matching engine like a regular order; namely, it can be a market order, or limit order and is processed accordingly.

Stop Orders can be used to: enter and increase the position following a trend, or to exit and decrease a position when the price moves against it. The latter is used more frequently, therefore Stop Orders are also informally called Stop Loss Orders. Also, this is why Stop Market Orders are used more regularly than Stop Limit Orders (your position will get closed, unlike stop-limit).

Stop Orders are generally smaller than others because they are usually used by traders with smaller funds, who want to protect their position but cannot watch the market 24/7 and do not have automatic trading systems.

A Buy Stop is an order to buy at the next available Ask Price when the last trade price reaches the Stop Price. A Sell Stop is an order to sell at the next available Bid Price when the bid decreased to the Stop Price.

Stop Orders can be either Stop Market or Stop Limit:

- Stop Market Order: Becomes a Market Order when the stop trigger price is reached.

- Stop Limit Order: Becomes a limit order once the stop price is reached.

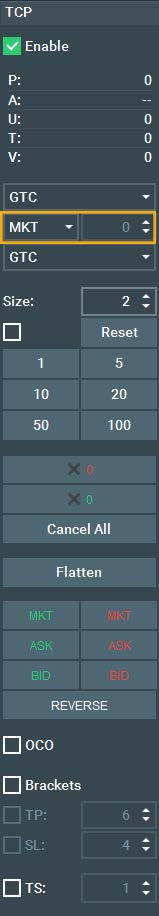

To choose between the two stop order types, set the stop order type on the Trading Configuration Panel to either MKT for a stop market order or LMT for a stop-limit order. When using a stop-limit order, set the stop order offset to indicate the limit price.

NOTE: An offset can be negative. This implies the limit order, when triggered, will be below (for buy stop) or above (for sell stop) the stop trigger price.ow the trigger price (for buy stop) or above the stop trigger price (for sell stop).

Bracket Orders

A Bracket Order is an order where one can enter a new position along with a target/exit and a stop-loss order. Upon the main order's execution, the system places two more orders (profit-taking and stop-loss). If one executes, the other auto-cancels.

To send bracket orders:

- Select the Brackets option on the Trading Configuration Panel.

- Choose the bracket order types and set their distance in ticks from the executed price of the leading order.

- They can be profit-taking limit orders, stop orders, or both.

- Bracket orders are sent for every executed order if the Brackets option was already selected.

Bracket order properties:

- Duration and type for stop-limit bracket orders match the set conditions of the leading stop order. The duration for the profit-taking limit order remains the same as the set conditions of the leading limit order.

- Once triggered, bracket orders function as OCO (One Cancels the Other) orders. Each OCO leg's price can be individually adjusted. Canceling one leg results in the other leg's cancellation. Modifying a leg's size might affect the other OCO leg, depending on the platform to which Bookmap is connected. See Special Orders for details.

- Note that size can only be modified downwards; i.e., you can only reduce the size of the order but not increase it.

For certain platforms/APIs supported by Bookmap, bracket orders are server-side, i.e., the instruction to send a bracket order following the execution of the leading order is not stored internally in Bookmap but on the broker/execution platform side. Conversely, some platforms/APIs use client-side bracketing, storing the orders in Bookmap until they are sent to the market. The location (server or client-side) matters if Bookmap disconnects or crashes. Client-side bracket orders may be lost during such interruptions, and won't be sent to the market upon reconnection. Using client-side bracket orders requires caution.

Details on platform/API server-side support can be found under Special Orders. For other platforms/APIs, brackets are client-side.

OCO Orders

When the OCO option is selected, traders can set two interlinked orders; when one fills, the other cancels. After setting the first OCO leg price, you'll be prompted to set the second. Both OCO orders are sent only after both leg prices are determined.

Each OCO leg's price can be individually adjusted. If one leg is cancelled, the other automatically cancels too. Adjusting a leg's size may impact the other leg, based on the linked Bookmap platform.

For more details, refer to Special Orders. Remember, order sizes can only decrease, not increase.

Trailing Stops

A Trailing Stop Order is a stop order that tracks the price of an investment vehicle as it moves in one direction, but the order will not move in the opposite direction.

To use Trailing Stops, activate the Trailing Stop option in the Trading Configuration Panel. A trailing stop will be entered for every Stop Order that is placed while the Trailing Stop check-box is checked. The trailing parameter controls the steps at which the stop order is updated and is measured in tick distance.

NOTE: Stop Orders placed to open a position will not be affected by Trailing Stops.

On certain platforms and APIs supported by Bookmap, trailing stops are server-side. This means the instructions aren't saved in Bookmap, but on the broker's side. Some platforms and APIs, however, don't offer server-side trailing stops; here, they'll be client-side i.e. kept in Bookmap. Depending on server or client-side storage, there can be implications if Bookmap disconnects or crashes. If it's client-side, the trailing stop won't function if Bookmap goes offline. Exercise caution with client-side trailing stops.

For specifics on platform/API support, see Special Orders.